- #YOU NEED A BUDGET COST FULL#

- #YOU NEED A BUDGET COST FREE#

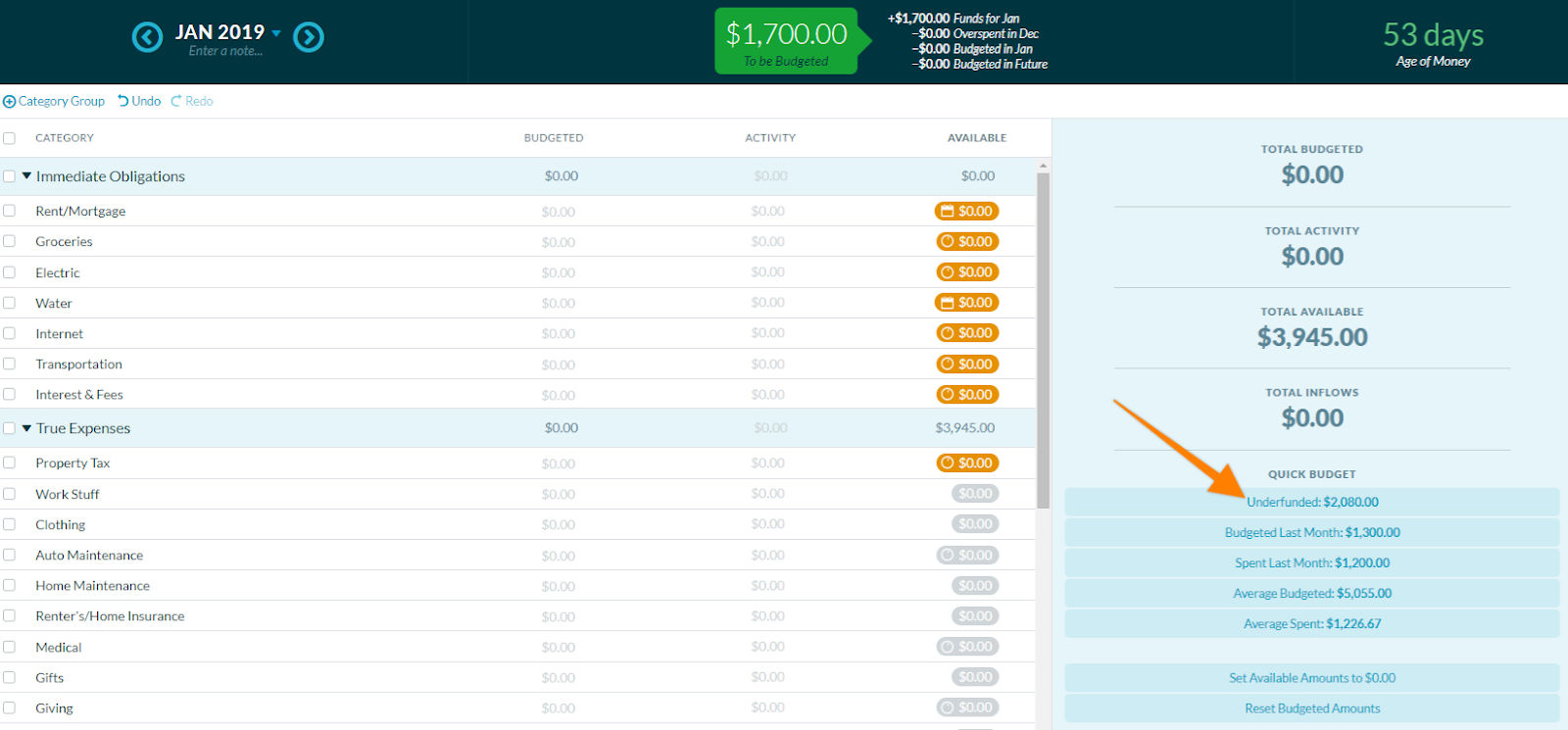

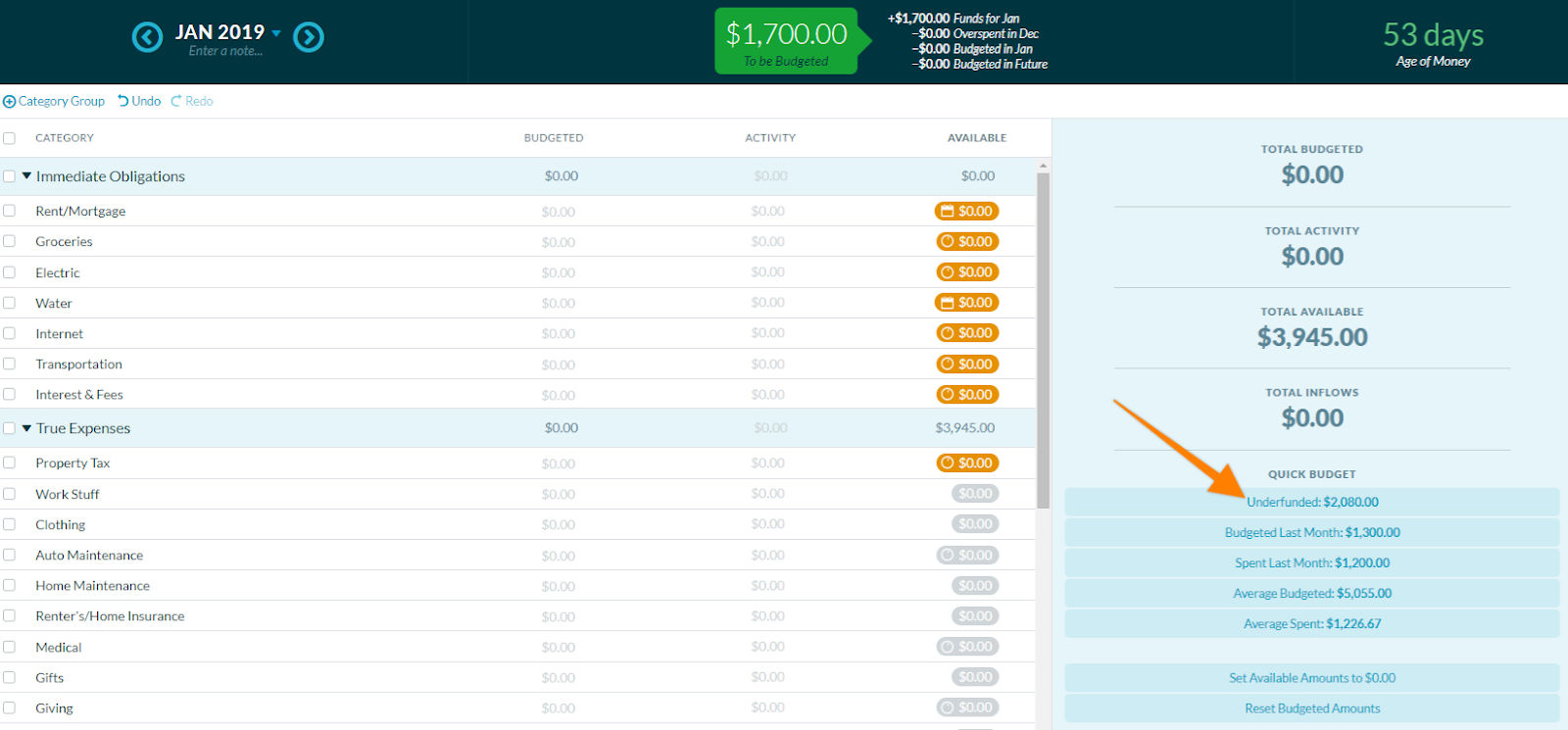

One way to get around this is to not put in your budgeted amount for that expense until you have the money, but I think that kind of defeats the purpose of a budget. If you put in what you’ve budgeted for that expense before you have the funds for it, you end up with a negative overall budget balance, which can be anxiety-producing just to see.

#YOU NEED A BUDGET COST FULL#

Hard to anticipate late-month expenses: This might just be us using it incorrectly or not to its full potential, but because YNAB uses a in-the-moment look at your bank statement based on what you’ve put in, it’s hard to budget for expenses that are coming in later in the month, after your second paycheck.If you can justify it for the sake of organizing your finances, it’s worth the investment.

#YOU NEED A BUDGET COST FREE#

A $60 expense can feel a little steep when you’re already struggling, especially since there are other free or less expensive options.

$ 60 up front cost: In many cases, people find themselves needing a budget when they are low on funds and need a way to organize. It’s easy to use, allows for keyboard shortcuts similar to Excel for quick receipt entry, and looks clean. User-friendly and simple: YNAB uses a very simple interface that only has what you really need. It can sit in your toolbox for when you need it, without the anxiety of constantly paying for it if you don’t use it for a month or two, or five. Non-subscription model: The $60 one-time purchase that you keep for life is a nice reprieve from the subscription models many companies have moved to. It’s best to do this at the start of a month to truly start fresh. You can enter what your bank account currently looks like and then go from there. Understanding reset options: If you’ve fallen behind in your tracking and receipt entering, you can reset YNAB with a “Fresh Start.” This allows you to start exactly where you are now. This is very helpful in a world where you can go to the same store for your groceries, household cleaning supplies, and alcohol. Inter-receipt categorizing: With YNAB, you can break each receipt into multiple categories, if needed. I can put in a little bit each month and save up for it. For example, I have a personal category dedicated to funding my next tattoo, which I know will be pricey. With YNAB, you can break these categories down as deep as you want, as well as adding more categories that better match your needs and spending habits, but also savings goals. The standards are, of course, your bills, groceries, and entertainment, but these are very broad categories. Infinite categories: A budget not only allows you to find a bottom line, but make sure you’re keeping that bottom line by staying on track with your spending in different categories. It’s helped us discover that we could afford to buy a house and made us comfortable with less income when I decided to quit my job to follow different career paths. In the two and a half years of our on-again, off-again relationship with YNAB, we’ve always found it to be a valuable and helpful tool in helping us stay on track with our expenses and make us feel better when money gets tight. It was $60, an expense we rationalized through our need for structure (and that it was a one-time, evergreen purchase). We found YNAB through Steam, an online catalog and gaming community. With less than $1,500 in our pocket after our move and two weeks until my husband’s first paycheck (and no job prospects for me yet), we found that we needed a way to track and control expenses to avoid any surprises any time we checked our account. We discovered You Need a Budget (YNAB) a few years ago when we first moved to Oregon.

0 kommentar(er)

0 kommentar(er)